← Back to Application Documents

How to Download Your NatWest Mortgage Statement

Your NatWest mortgage statement shows your balance, interest rate and recent transactions — useful when reviewing your deal, remortgaging, or exploring equity release. You can access it online via the NatWest app or Online Banking, and even opt to receive your annual statement digitally through their paperless service.

Want a quick sense-check on whether your deal is still competitive? Book a free intro call and we’ll talk you through your options.

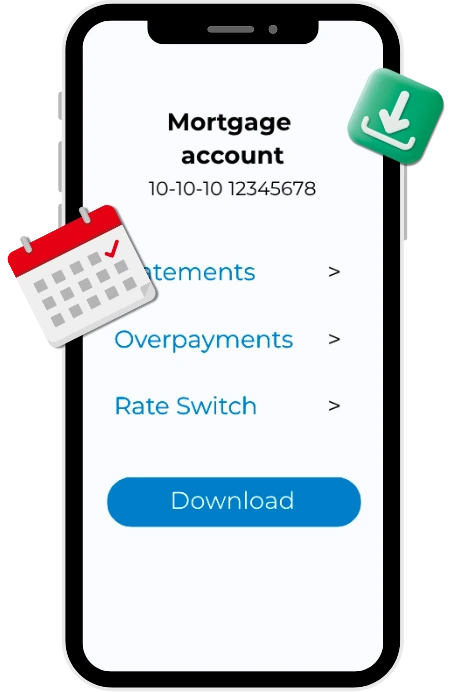

In the NatWest Mobile App

- Open the NatWest app and log in securely.

- Select your mortgage account from the account list.

- Choose Manage your Mortgage to see your balance and sub accounts.

- Tap Mailbox to view any digital correspondence or paperless statements.

You can switch between accounts and download PDF statements directly from the app.

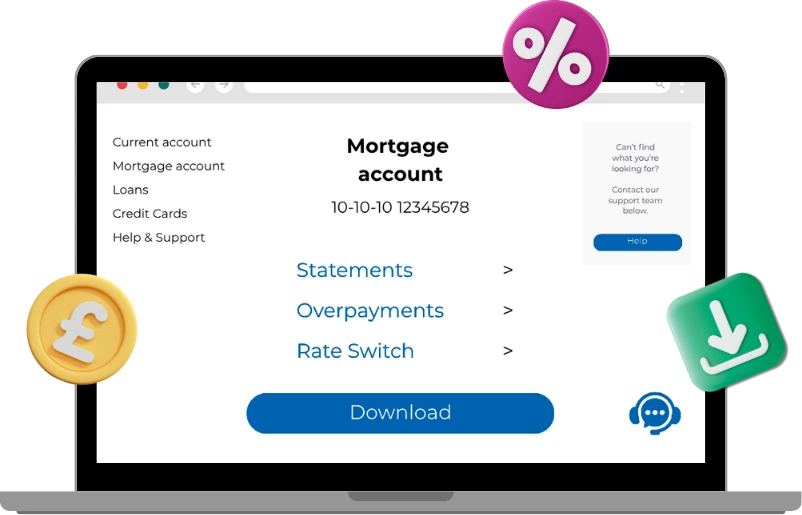

Using NatWest Online Banking

- Go to the NatWest Online Banking login page and sign in.

- Select your mortgage account from your dashboard.

- Click Manage your Mortgage to view details, make changes or download your statement.

- Under Paperless settings, you can switch to receive your statements online instead of by post.

You’ll receive an email notification whenever a new digital statement is available.

Registering and Receiving Your Statement

When you first register for NatWest Online Banking or the mobile app, you’ll need your mortgage account number. This can be found on your most recent mortgage statement. Once registered, NatWest will provide you with a customer number to keep for future logins.

NatWest issues an annual mortgage statement each year around your mortgage anniversary. You can view this online if you’ve switched to paperless or receive a paper copy by post.

- Log in and check your Mailbox for digital copies.

- Or call 0345 302 0190 to request a paper reprint.

What does your mortgage statement tell you?

- Your interest rate and mortgage deal type

- Your remaining mortgage balance

- Your monthly payments

- Any fees or charges applied to the mortgage

If you'd like help understanding what your statement means for your mortgage options, book a free intro call and we can talk it through.

Looking for a different lender?

Select your lender below to view the right mortgage statement guide.

Need to Review Your Mortgage?

We’ll review your current deal, compare it against market-leading rates, and explain your options clearly — whether that’s remortgaging, releasing equity, or simply staying put with confidence.

No pressure, no jargon — just a clear view of your options.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

IMPORTANT: With investments, your capital is at risk. Pensions and investments can go down in value as well as up, so you could get back less than you invest.

Need Financial Planning Ltd is registered in England and Wales no. 10901658. Registered office, 123 High Street, Broadstairs, Kent, CT10 1NQ. Authorised and regulated by the Financial Conduct Authority. Need Financial Planning Ltd is entered on the Financial Services Register https://register.fca.org.uk/ under reference 977136. If you wish to register a complaint, please write to [email protected] or telephone 01843 228800. A summary of our internal complaints handling procedures for the reasonable and prompt handling of complaints is available on request and if you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service at www.financial-ombudsman.org.uk or by contacting them on 0800 0234 567.

© Copyright 2022 Need Financial Planning Ltd. All rights reserved. Privacy Policy | Disclaimer | Cookie Policy